Create your own bot

What is a Crypto‑margined Hedging grid?

This is a hedging strategy designed for spot holders. If you hold a token long term (e.g., BTC or ETH), your biggest concern is downside risk when the price drops. This strategy helps manage that risk by running a 1x crypto‑margined short perpetual grid.

Core hedging mechanism: You use BTC as margin to create a 1x short grid. When BTC falls, profits from the short grid can help offset the unrealized losses on your spot holdings, providing a hedge.

Three income engines: While hedging, the bot may also generate additional income, such as grid profits, funding fee income, and Auto‑earn returns.

About this bot

In crypto, the shift from bull market euphoria to a bear market can happen fast. In July 2025, after BTC hit a new all-time high of 120,000 USDT, uncertainty rose sharply. Do you take profits and risk missing further upside, or keep holding and accept the downside risk?

The Crypto‑margined Hedging grid offers a third option: hold with more peace of mind, without trying to time the market. It helps reduce drawdowns by hedging during declines, and captures spread profits through grid trading during sideways moves. It may not deliver the highest returns in a bull market, but it can help you lose less in a bear market, and potentially stay profitable, so you can navigate the full market cycle more steadily.

Leo is a long-term BTC believer. Even after BTC broke above 120,000 USDT, he continued holding 5 BTC. After BTC pushed to a new high around 120,000 USDT in July 2025, Leo expected a deep pullback and decided to start a hedging strategy.

On Jul 14, 2025, with BTC trading around 120,000 USDT, Leo used 5 BTC as margin to create a “BTC/USD 1x crypto‑margined short hedging grid,” with a price range of 80,000 - 130,000 USDT.

Oct 28, 2025: During this period, BTC traded sideways between 108,000 and 125,000 USDT. Leo’s short grid repeatedly opened positions near the upper bound and completed short-term trades, building up grid profits while consistently earning funding fees.

Nov 1, 2025: Market sentiment reversed and BTC entered a downtrend, breaking below key support levels at 110,000 and 100,000 USDT before dipping to 90,000 USDT. During this move, Leo’s short grid saw a sharp increase in unrealized PnL and grid profits, fully offsetting the roughly 25% drawdown in the value of 5 BTC spot holdings.

Throughout: Grid profits and Auto‑earn compounding gradually increased Leo’s 5 BTC margin.

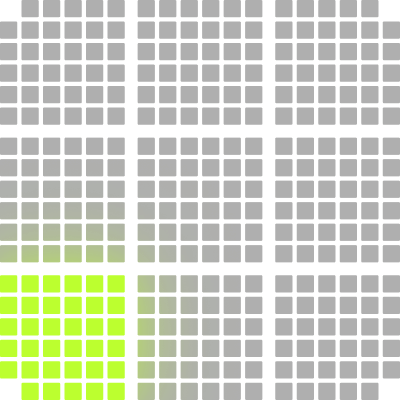

By late Nov 2025, BTC had stabilized around 80,000 USDT, and Leo stopped the strategy. Results:

Successful hedge: Profits from the hedging grid covered the unrealized losses on spot holdings, helping Leo protect the gains Leo had built up during the bull market.

Extra income: During the run, Leo earned an additional 0.49 BTC from grid profits, funding fees, and Auto‑earn returns.

Throughout the sell-off, Leo stayed calm, because Leo’s position was hedged.

Bot setup

Zero profit sharing

Zero management fees